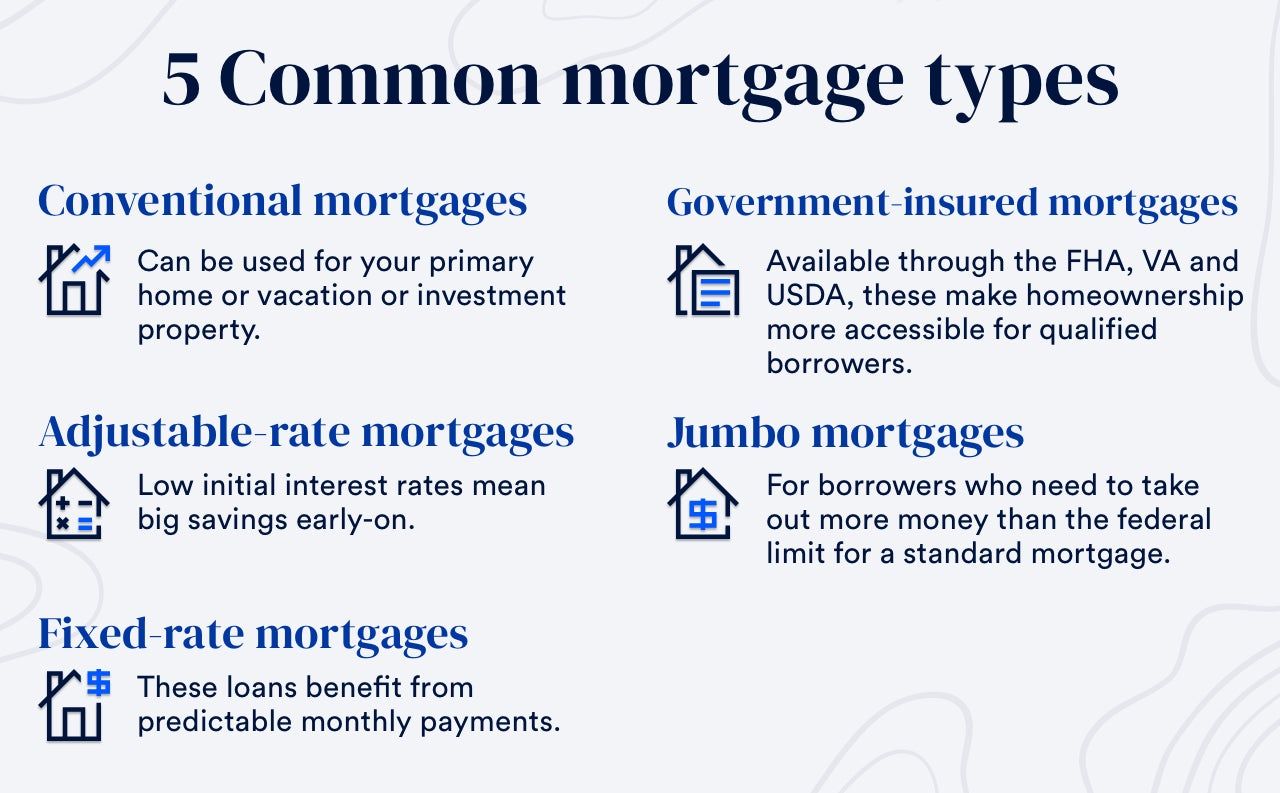

Real estate loans and mortgages are the backbone of the real estate industry. They provide individuals with the financial means to purchase properties and invest in real estate. However, not all loans and mortgages are created equal. There are various types available to cater to different needs, financial situations, and goals. In this article, we will explore some of the most common types of real estate loans and mortgages.

1. Conventional Loans

Conventional loans are the most popular type of mortgage for homebuyers. These loans are not insured or guaranteed by the government and are provided by private lenders such as banks, credit unions, and mortgage companies. To qualify for a conventional loan, borrowers typically need good credit scores, stable income, and a down payment of at least 20% of the purchase price. Conventional loans offer a fixed or adjustable interest rate and can be used for various types of properties, including single-family homes, condominiums, and multi-unit buildings.

2. FHA Loans

FHA (Federal Housing Administration) loans are government-insured mortgages designed to make homeownership more accessible to individuals with limited financial resources or lower credit scores. These loans are issued by approved lenders but insured by the FHA, which means lenders can offer more favorable terms and interest rates. FHA loans require a smaller down payment (usually around 3.5%) and have more flexible qualification criteria compared to conventional loans. They are particularly beneficial for first-time homebuyers and individuals who may not meet the strict requirements of conventional loans.

3. VA Loans

VA (Veterans Affairs) loans are available exclusively to military service members, veterans, and their surviving spouses. These loans are backed by the VA and provide favorable terms and zero down payment options for eligible borrowers. VA loans offer flexible qualification requirements and do not require mortgage insurance. They can be used to purchase a primary residence, including single-family homes, condos, and manufactured homes. VA loans are known for their competitive interest rates and are a valuable benefit for those who have served in the military.

4. USDA Loans

USDA (United States Department of Agriculture) loans are designed to promote rural development and homeownership in eligible areas. These loans offer 100% financing, meaning no down payment is required, and provide competitive interest rates. To qualify for a USDA loan, borrowers must meet income and credit requirements, and the property must be in a designated rural area. USDA loans are an excellent option for low-to-moderate-income borrowers looking to purchase a home in rural communities.

5. Jumbo Loans

Jumbo loans are mortgages that exceed the conventional loan limits set by Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy and sell mortgages. These loans are designed for high-priced properties that surpass these limits. Jumbo loans come with higher interest rates, stricter qualifying criteria, and typically require a larger down payment. They are popular among affluent buyers and are prevalent in luxury real estate markets where property values are higher than average. Jumbo loans allow individuals to borrow large amounts of money to finance their dream homes.

6. Adjustable-Rate Mortgages

An adjustable-rate mortgage (ARM) is a type of loan where the interest rate is fixed for a specific period and then adjusts periodically based on market conditions. ARMs usually have lower initial interest rates compared to fixed-rate mortgages, making them attractive to borrowers looking for short-term financing or expecting interest rates to decrease in the future. However, once the initial fixed period ends, the interest rates can fluctuate, potentially resulting in higher monthly payments. ARMs come with specific terms and adjustment periods, such as 3/1, 5/1, and 7/1, indicating the initial fixed rate period and how often the rate adjusts afterward.

Conclusion

Choosing the right type of real estate loan or mortgage is crucial when buying a property. Each option has its own set of advantages and considerations, depending on a borrower’s financial situation, creditworthiness, and long-term goals. It’s essential to consult with a knowledgeable mortgage professional to understand the available options and select the most suitable loan or mortgage for your real estate endeavors.