When it comes to estate planning, it is essential to consider all your assets, including real estate. Real estate assets can hold significant value and form a significant part of your estate. Therefore, it is crucial to understand how to manage and plan for them effectively. In this article, we will explore various aspects of estate planning and real estate assets.

Understanding Estate Planning

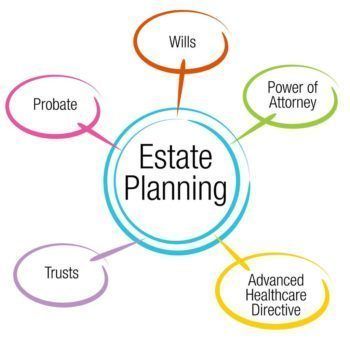

Estate planning is the process of preparing for the transfer of an individual’s assets after their death. It involves creating a comprehensive plan that ensures the distribution of assets according to the individual’s wishes while minimizing taxes and legal complications.

Real estate assets can include residential properties, commercial properties, rental properties, land, or any other real property owned by an individual. These assets can have sentimental and financial value and may come with unique challenges during the estate planning process.

Identifying and Documenting Real Estate Assets

The first step in effective estate planning for real estate assets is to identify and document all the properties you own. This includes gathering relevant paperwork such as property deeds, mortgage documents, insurance policies, and any agreements related to the properties.

Having a clear record of your real estate assets will help your beneficiaries and legal representatives understand the details of each property, such as ownership, outstanding loans, and any specific instructions you may have regarding their distribution.

Get Professional Help

Estate planning, especially when it involves complex real estate assets, is not a task to undertake alone. It is wise to consult with an experienced estate planning attorney who specializes in real estate matters. They can guide you through the legal requirements, tax implications, and options available to ensure your real estate assets are properly structured and protected.

An attorney can help you create essential estate planning documents such as wills, trusts, and powers of attorney. They can assist you in establishing the best approach to distributing your real estate assets and developing strategies to mitigate potential conflicts among beneficiaries.

Consider the Future

Real estate assets may appreciate or depreciate over time. When creating an estate plan, it is vital to consider the future value of your properties. This will help in making informed decisions about whether to hold onto the properties or sell them.

Additionally, you may want to consider transferring ownership or management responsibilities of your real estate assets to your beneficiaries during your lifetime. This can save time, costs, and potential disputes after your passing. It is essential to consult with legal and tax professionals to understand the implications of such transfers.

Addressing Tax Implications

Real estate assets can have significant tax implications, which must be considered during estate planning. Depending on the jurisdiction, there may be inheritance taxes, capital gains taxes, and property taxes that affect the value of the estate and the beneficiaries’ inherited assets. Understanding and planning for these taxes can help minimize their impact.

Additionally, tax laws and regulations change over time. Regularly reviewing and updating your estate plan can ensure it aligns with the current tax laws, maximizing the benefits for your beneficiaries.

Reviewing and Updating

An estate plan is not a one-time task. Major life events such as marriage, divorce, birth, or the acquisition of new properties should trigger a review of your estate plan. Regularly updating your plan will ensure it reflects your current wishes and covers any changes to your real estate assets, ensuring efficient estate administration.

Conclusion

Estate planning is a crucial step to ensure your real estate assets are properly managed and distributed according to your wishes. Real estate assets come with unique challenges and tax implications, making it crucial to seek professional advice. By identifying and documenting your assets, reviewing and updating your plan regularly, and considering the future value of your properties, you can create a robust estate plan that safeguards your real estate assets and provides for your loved ones.