Environmental, Social, and Governance (ESG) factors play an increasingly vital role in real estate investments. The integration of ESG considerations has become an essential aspect of modern investment strategies across various sectors.

Benefits of ESG in Real Estate Investments

Investing in real estate projects that align with ESG principles delivers numerous advantages for both investors and society as a whole.

1. Financial Performance and Risk Mitigation

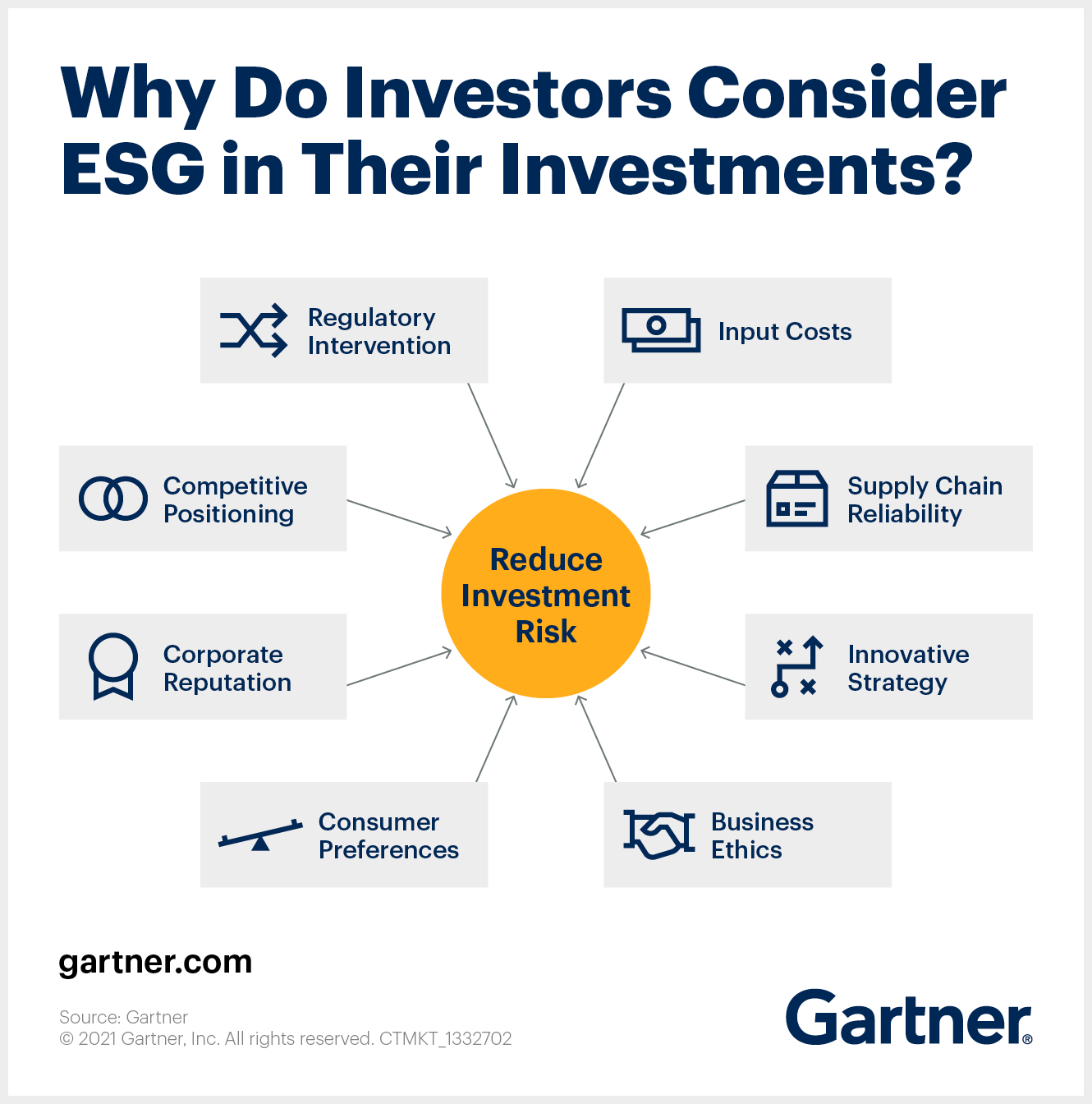

Research has shown that companies and real estate assets with strong ESG performance exhibit better financial and operational results. By considering ESG factors in real estate investments, investors can identify opportunities that have a lower risk profile and the potential to generate sustainable long-term returns.

2. Enhancing Property Value

Integrating ESG factors into real estate investments can lead to the improvement of property value and the attractiveness of projects to potential tenants. Efficient use of resources, sustainable building practices, and environmental certifications like LEED contribute to increased marketability and rental demand.

3. Social Impact

Incorporating ESG principles into real estate investments can create positive social outcomes. Promoting affordable housing, community development, and sustainable urban regeneration projects can contribute to enhanced social well-being and support local communities.

ESG Integration in Real Estate Investment Strategies

To effectively integrate ESG factors into real estate investment strategies, investors can adopt several approaches:

1. ESG Data and Metrics

By utilizing specialized ESG data providers, investors can access comprehensive information on the environmental, social, and governance performance of real estate assets. These metrics help evaluate investments and compare the sustainability performance across different assets and portfolios.

2. ESG Due Diligence

Conducting thorough ESG due diligence during the investment process is critical to identify potential risks and opportunities. This involves analyzing a broad range of factors such as energy efficiency, waste management, regulatory compliance, labor practices, community engagement, and board diversity.

3. Engagement and Collaboration

Active engagement with real estate companies and developers is essential for influencing positive change. Investors can leverage their influence to encourage the adoption of sustainable practices, improved transparency, and ESG reporting. Collaborative initiatives among investors, industry associations, and regulatory bodies can amplify the impact of ESG integration in the real estate sector.

ESG Certification and Industry Standards

Several certifications and industry standards have been developed to encourage and recognize the implementation of ESG principles in real estate investment practices. Some notable examples include:

1. LEED Certification

The Leadership in Energy and Environmental Design (LEED) certification is a globally recognized rating system that evaluates the environmental performance of buildings and encourages sustainable construction practices. LEED-certified buildings are preferred by tenants and investors seeking environmentally responsible investments.

2. GRESB

The Global Real Estate Sustainability Benchmark (GRESB) assesses the ESG performance of real estate portfolios and companies worldwide. GRESB provides a standardized framework for evaluating ESG factors in real estate investments and promotes transparency, benchmarking, and continuous improvement.

3. BREEAM

The Building Research Establishment Environmental Assessment Method (BREEAM) is a widely used sustainability assessment methodology that sets standards for sustainable building design, construction, and operation. BREEAM certification enhances the sustainability credentials of real estate assets and promotes responsible investment practices.

Conclusion

ESG considerations have become integral to real estate investments, delivering substantial benefits in terms of financial performance, risk mitigation, property value enhancement, and social impact. As the importance of sustainable practices grows, investors should actively integrate ESG factors into their investment strategies to ensure long-term success in the ever-evolving real estate market.