The outbreak of a pandemic can have far-reaching consequences on various sectors of the economy, including housing markets. Pandemics like the COVID-19 crisis, for instance, have brought significant changes to the real estate industry. This article explores the impact of pandemics on housing markets and how they affect property values, buyer behavior, and housing trends.

1. Economic Uncertainty

One of the immediate effects of a pandemic on housing markets is increased economic uncertainty. During such periods, people tend to become more cautious about their finances, leading to a decrease in property transactions. The uncertainty arising from job losses, reduced income, and fear of future financial instability can create a freeze in the housing market, causing a decline in demand and slower sales.

2. Property Values

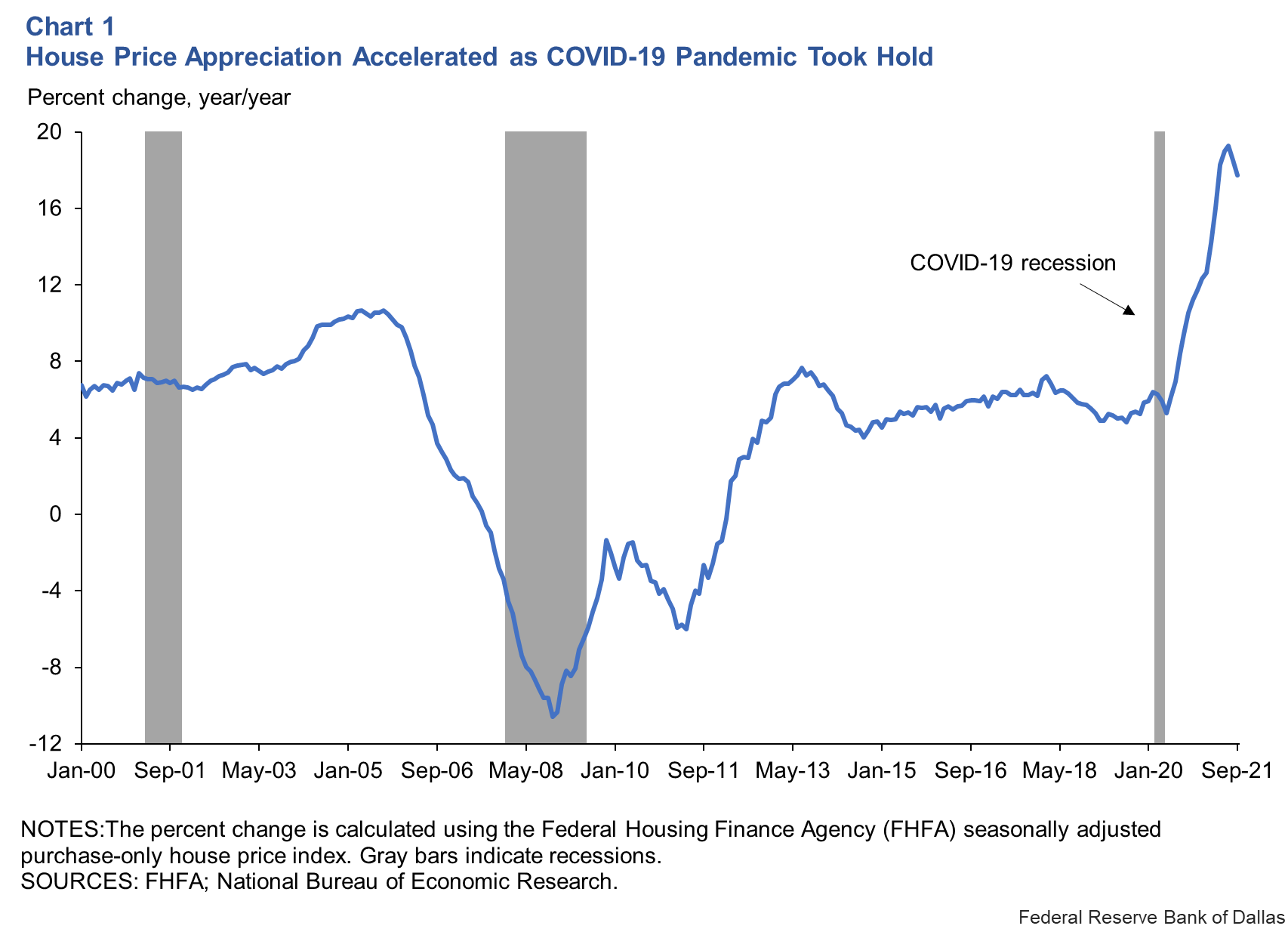

Pandemics can lead to a decline in property values. As economic activity slows down due to restrictions and lockdown measures, demand for housing decreases. This reduced demand puts pressure on property prices, resulting in a decline. Additionally, the increased uncertainty and financial stress on individuals may lead to more foreclosures, further impacting property values negatively.

3. Shift in Buyer Preferences

Pandemics often change buyers’ preferences when it comes to housing. With the rise of remote working and increased focus on health and safety, there is a noticeable shift towards properties that offer more space, including larger homes, open floor plans, and dedicated home office spaces. Additionally, buyers may prioritize properties located in less densely populated areas where the risk of infection is perceived to be lower. These changing preferences can impact the demand and value of different types of properties.

4. Rental Market

Pandemics can significantly impact the rental market as well. In times of economic uncertainty, many individuals face financial difficulties and may struggle to pay rent. This can lead to an increase in rental delinquencies and, in severe cases, a rise in evictions. Moreover, the decrease in demand for short-term rentals due to travel restrictions can further strain the rental market, causing rental prices to decline.

5. Shift in Development Focus

Pandemics can also influence the focus of real estate developers and investors. During and after a pandemic, there may be a higher demand for affordable housing solutions, as many individuals face financial hardships. Developers might also shift their attention towards properties that cater to changing buyer preferences, such as green spaces, outdoor amenities, and technology-driven features that promote health and well-being.

6. Policy and Regulation Changes

Government policies and regulations can play a crucial role in mitigating the impact of a pandemic on the housing market. In response to economic downturns, governments may introduce measures such as mortgage forbearance programs or rent freezes to provide relief to homeowners and renters. Additionally, policymakers might implement changes to zoning regulations or offer incentives to developers to encourage affordable housing construction.

Conclusion

Pandemics have a profound impact on housing markets, affecting property values, buyer preferences, and rental markets. The economic uncertainty, change in buyer behavior, and policy responses during pandemics shape the trajectory of the real estate industry. It is essential for governments, developers, and investors to understand these impacts and adapt their strategies to ensure the stability and resilience of housing markets in times of crisis.